GLASGOW, Scotland – Nami Surgical has appointed Nikki Palfrey as CEO while completing its latest investment round. The company is targeting the global robotic-assisted surgery market with its pioneering ultrasonic technology, with the funding supporting the company’s transition from advanced development to commercialisation.

Nami develops high-performance miniaturised ultrasonic scalpels; its platform has been engineered for integration into articulated, wristed surgical robotic instruments, addressing growing demand for compatibility with next-generation robotic systems. The robotic-assisted surgery market is forecast to reach over $25 billion by 2030.

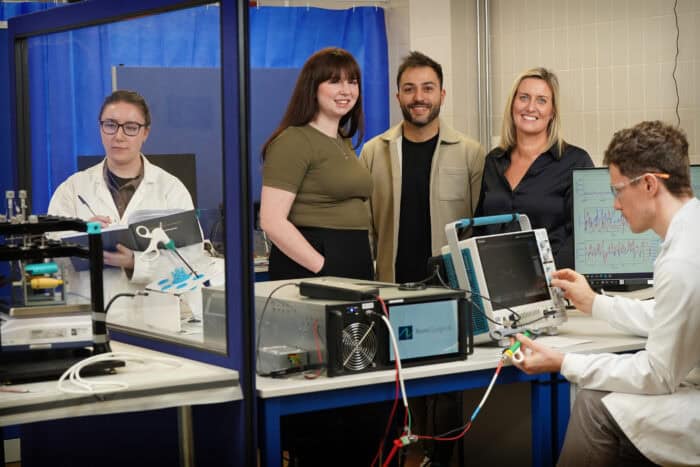

Nikki Palfrey, who has been a Non-executive Director at Nami since 2023, brings over 25 years of leadership experience in the MedTech sector, leading businesses such as Summit Medical and BOWA Medical UK through growth, transformation and global expansion. As CEO, Palfrey will lead Nami’s commercial strategy and partner engagement as the company progresses towards market entry. Co-founder Dr Nico Fenu moves to the COO role at Nami, the University of Glasgow spinout he founded alongside CTO Dr Rebecca Cleary in 2021.

Nikki Palfrey, Nami Surgical CEO, said: “Nami is exceptionally well positioned to become a leading force in the robotic-assisted surgery market. Building on the strong foundations established by Nico, Rebecca, and the entire team, I am excited to lead the company as we enter an exciting new chapter focused on innovation, scale, and long-term value creation.”

Dr Nico Fenu, Co-founder and COO of Nami Surgical, said: “As founders, Rebecca and I are incredibly proud of how far Nami has come. We are excited about the opportunities ahead in a rapidly growing global market and remain deeply committed to our mission of improving patient outcomes worldwide.”

Nami recently completed its latest investment, a £1.9 million round led by Eos Advisory with participation from the Investment Fund for Scotland managed by Maven Capital Partners (and delivered by the British Business Bank), and Scottish Enterprise.

Current US-based adviser David O’Reilly has been formally appointed as Eos Advisory’s Investor Director and joins Nami’s board, which is chaired by Albert Nicholl. O’Reilly brings deep experience in scaling high-growth technology businesses and strengthens the company’s strategic and governance capabilities as Nami moves towards commercial execution.

David O’Reilly said: “Nami’s miniaturised ultrasonic platform is exactly the kind of enabling breakthrough that can reshape the competitive landscape in robotic surgery and notably marks a gap in the portfolios of the major medical robotic companies in the space.”

About Eos

Eos is a hands-on, early-stage and growth investor in science and technology innovations that seek to address societal and environmental issues. With deep roots in Scotland and a global approach, Eos was founded in St Andrews in 2014. The 4 impact areas Eos focuses on are 1) Disease Diagnosis, Prevention and Treatment, 2) Food and Water security, 3) Energy Security, Climate Change and Pollution and 4) Improvement and Sustainability of Industrial Processes.

About Maven Capital Partners

Maven Capital Partners is one of the UK’s leading private equity firms, specialising in investments in high-growth British companies. With a focus on innovation and value creation, Maven partners with visionary entrepreneurs to build market-leading businesses, supporting a range of transaction types, including management buyouts, growth capital, buy and build projects, equity value release and pre-IPO financing.

About the Nations and Regions Investment Funds and the Investment Fund for Scotland

The Nations and Regions Investment Funds increase the supply and diversity of early-stage finance for UK smaller businesses, providing finance to firms that might otherwise not receive investment and help to break down barriers in access to finance.

Operating in a commercially sustainable way the Nations and Regions Investment Funds deliver a £1.6bn commitment of new funding through investment strategies that best meet the needs of the businesses in their nation or region.

The British Business Bank is responsible for administering the Nations and Regions Investment Funds on behalf of the UK government. We have established investment funds in areas not currently served by the Bank’s existing regional funding programme as well as launching follow-on investment funds in existing fund areas.

The £150m Investment Fund for Scotland offers a range of commercial finance options with small loans from £25,000 and equity investment up to £5m. The fund has a demonstrable presence across Scotland, linking up with the existing small business finance ecosystem to increase reach and create an impact by helping to boost productivity, innovation and jobs.

The funds in which the IFS invests are open to businesses with material operations, or planning to open material operations, in all areas of Scotland.

www.investmentfundscotland.co.uk

About Scottish Enterprise

Scottish Enterprise (SE) is Scotland’s national economic development agency and a non-departmental public body of the Scottish Government. It supports businesses to innovate and scale to transform the Scottish economy by focusing on new market opportunities through targeted investment, innovation and internationalisation. Follow us on LinkedIn.

All images © Stewart Attwood Photography 2026. All other rights are reserved. Use in any other context is expressly prohibited without prior permission.